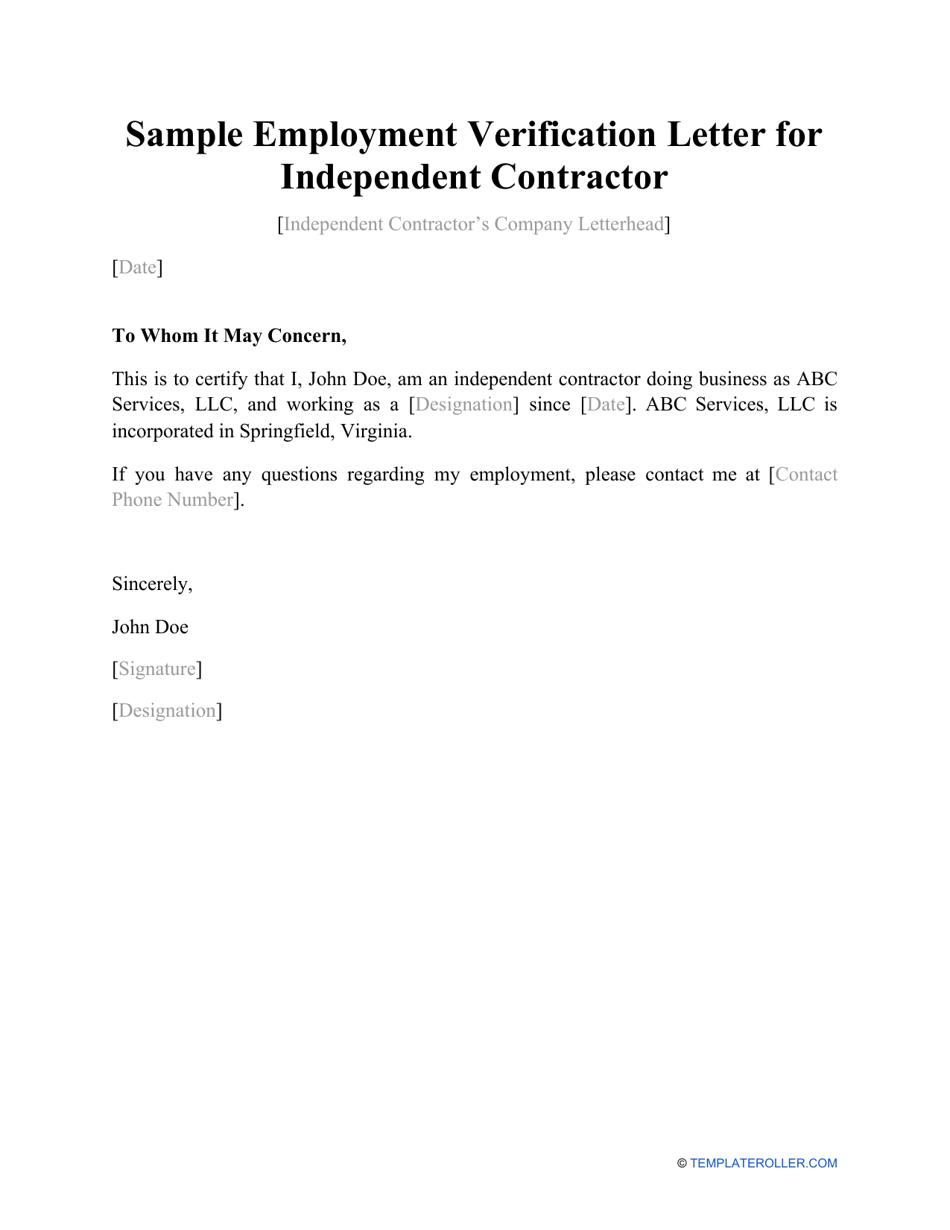

Proof of Income for Self Employed Individuals Verificationįor self-employed individuals, basically have no one to draft a proof of income letter on their behalf, so their only option is to craft one on their own.

Benefits verification letter/Social security proof of income.Some of the documents that are usually accepted as proof of income include: Third parties often require individuals to validate their proof of income letters with at least two proof of income documents in order to protect themselves against false claims. The last step taken by banks before approving a loan, landlords before approving an individual for tenancy, or organizations before approving individuals for employment is usually asking them to provide proof of income letter. Once you’ve obtained all the necessary information, you can request a credit report from Equifax, Transunion, or Experian. You can also ask them to provide you with the necessary information to help you facilitate the check from your end by giving them a background check authorization form to fill. If you are not able to get hold of the individual’s bank statements/paystubs or their tax returns, you may consider asking them to provide you with their credit report.

#EMPLOYMENT VERIFICATION LETTER FREE#

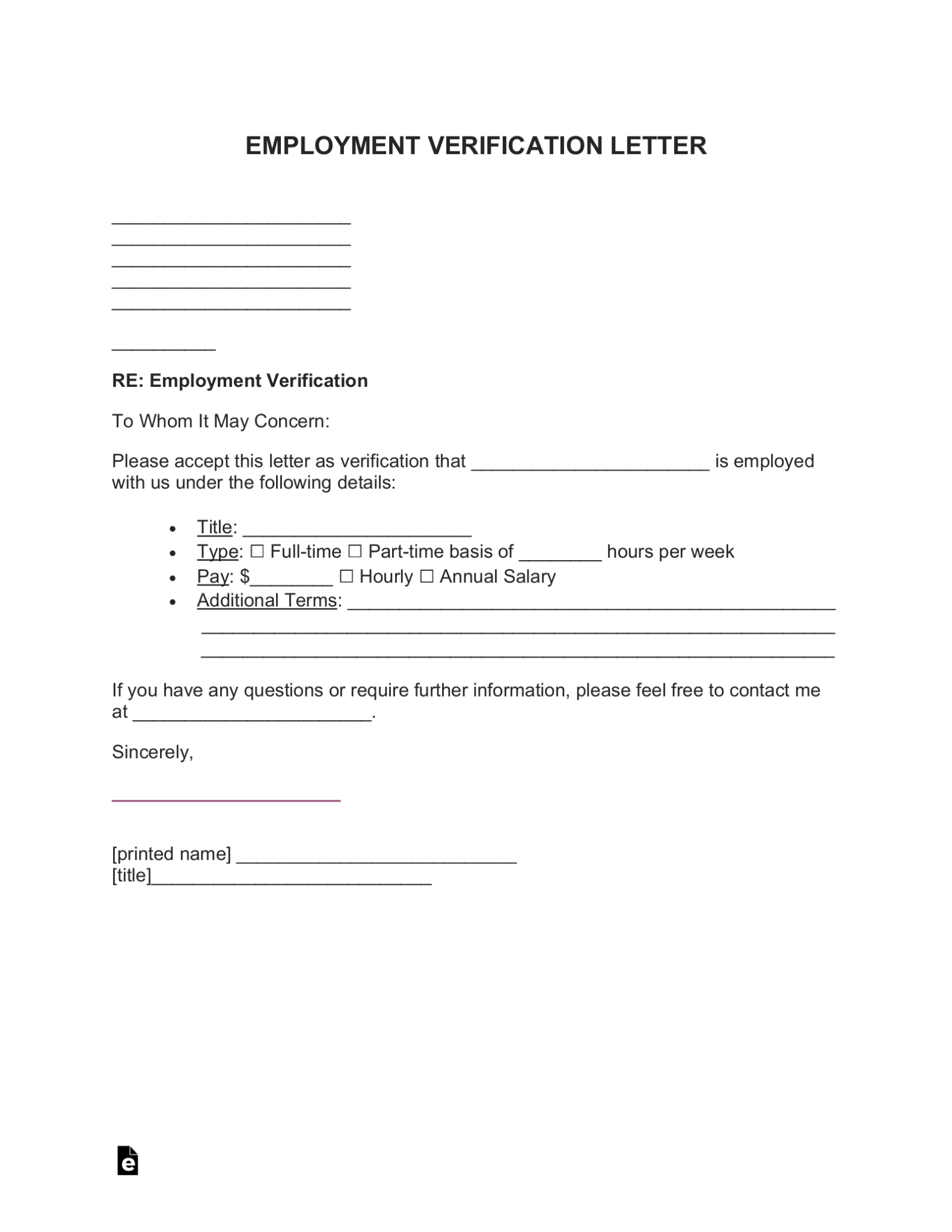

This usually takes about 1-3 business days and is free of charge. For Self-employed individuals- request IRS Form 1040Īdditionally, you may request the individual to submit the IRS Form 4506-T, which requests the federal government to verify the individual’s income from the previous year.For individuals (paid in cash)- request IRS Form W-2.You can use their tax returns to gauge whether their monthly income and spending habits will enable them to repay their loans, rent or mortgage, etc. In cases where the individual is either self-employed or is paid with cash, you should consider asking them to furnish you with their past two years of income taxes. Step 4: Obtain past 2-years of tax returns Step 3: Obtain past pay stubs/bank statementsĭepending on your reason for requesting the employment verification letter, you may consider asking the employer to furnish you with at least two pay stubs or the employee to give you their bank statement to help you get an insight into their spending habits and check to see if they will be able to furnish their monthly payments. The best and fastest way to get a response would be to call the employer however, if their contact is not provided or not going through, you may consider sending in an email to their official company email. Should you have any questions regarding the information provided, kindly contact me at _ or email me at _ and I will get back to you at the earliest convenience.Īfter checking the business entity’s status and verifying the principals or business owners, the next step is to contact them to verify that they indeed signed the letter. I would like to certify that all the information provided herein is accurate and true to the best of my knowledge. Įnclosed with this document are the following supporting documents He/she has been an employee at _ and holds the title of _. There are many reasons why an employer might need to issue an Employment Verification Letter.This letter is to verify the employment and income status for _. When do I need to Issue an Employment Verification Letter? This letter can be used to provide proof of employment for a variety of reasons, such as when applying for a loan or a mortgage. What is an Employment Verification Letter?Īn Employment Verification Letter is a letter from an employer that verifies that an employee is employed with that company and provides certain information about their job title, hours worked, and salary.

0 kommentar(er)

0 kommentar(er)